The Basic Principles Of Estate Planning Attorney

Getting My Estate Planning Attorney To Work

Table of ContentsWhat Does Estate Planning Attorney Do?A Biased View of Estate Planning AttorneyEstate Planning Attorney Things To Know Before You BuyAll About Estate Planning Attorney

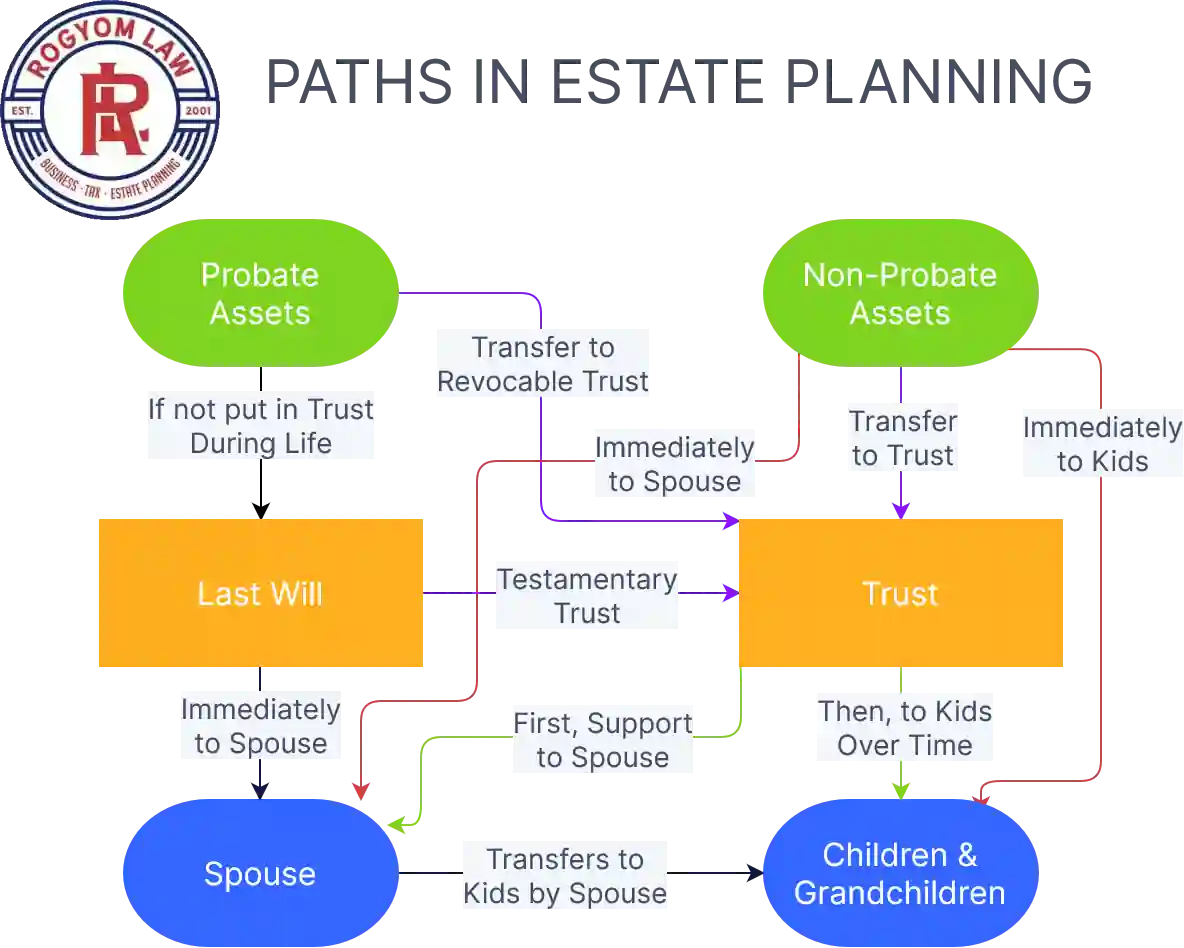

Estate preparation is an action plan you can utilize to establish what happens to your possessions and commitments while you live and after you die. A will, on the various other hand, is a lawful document that describes just how properties are distributed, who takes care of kids and pets, and any other desires after you pass away.

Cases that are rejected by the executor can be taken to court where a probate court will have the final say as to whether or not the insurance claim is legitimate.

The Buzz on Estate Planning Attorney

After the inventory of the estate has been taken, the value of assets calculated, and taxes and debt paid off, the executor will then seek authorization from the court to distribute whatever is left of the estate to the beneficiaries. Any estate taxes that are pending will certainly come due within 9 months of the day of fatality.

Each private areas their possessions in the depend on and names a person various other than their partner as the beneficiary., to support grandchildrens' education.

10 Easy Facts About Estate Planning Attorney Explained

This technique entails freezing the worth of an asset at its value on the date of transfer. As necessary, the amount of possible funding gain at fatality is likewise iced up, allowing the estate coordinator to estimate their prospective tax obligation liability upon fatality and better plan for the settlement of income the original source tax obligations.

If sufficient insurance coverage proceeds are offered and the plans are properly structured, any type of revenue tax on the considered personalities of assets complying with the fatality of a person can be paid without resorting to the sale of possessions. Profits from life insurance policy that are gotten by the recipients upon the death of the insured are normally income tax-free.

There are certain files you'll need as part of the estate planning process. Some of the most typical ones consist of wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a misconception that estate preparation is just for high-net-worth people. That's not true. Estate planning is a tool that everyone can use. Estate preparing makes it much easier for individuals to identify their desires before and after they die. Unlike what many people think, it expands past what to do with possessions and obligations.

Things about Estate Planning Attorney

You must begin planning for your estate as quickly as you have any quantifiable property base. It's a continuous procedure: as life progresses, your estate plan need to shift to match your conditions, in line with your new goals.

Estate planning is frequently believed of as their website a device for the well-off. Estate preparation is also a terrific means for you to lay out strategies for the care of your minor children and animals and to describe your desires for your funeral service and favored charities.

Qualified applicants who pass the test will be officially licensed in August. If you're eligible to sit for the examination from a previous application, click this link you might file the short application.